It is dream for many Indians to look for job opportunity outside India. Specially migrating to Canada, New Zealand, UK, USA, Dubai and Singapore. You may have seen many blogs on how to migrate. This post is not about how to but why to migrate. Is it worth the “money”?

It is a dream for many Indians to look for job opportunities outside India. One of the key reasons for this thought process is to earn more money. There could be many other reasons like studies, infrastructure, family, status, quality of facilities, etc. We see ads about New Zealand immigration from India, Migration to Canada from India, and Canadian Immigration. There are enough google searches about How to get Green Card in the USA and where are Canadian Embassies in India.

In this article, I am going to talk about the money aspect of migration. Making more money is one of the big reasons for people to move to developed countries. E.g. When someone is looking to migrate to the USA, they look at the USD to INR conversion which today (7th Jul 2021) is at 1USD = 74.81 or ~75 INR. People convert potential salary in USD with salary in INR. Obviously, USD Salary wins with a huge margin. The same thing happens when we compare the Canadian Dollar, UK Pound Sterling, Euro, NZ Dollar, UAE Dirham, or Singapore Dollar with Indian Rupees (INR). This conversion is based on Foreign Exchange Rate or Forex Rate. It works perfectly fine when you are transferring money!

But the story is very different when we use this money to buy things or consume services to live life in different countries. Money is of no use unless we buy goods and services using that. The real value of money is determined by using that otherwise it is just a number or a paper. Covid has taught us that! This value can be demonstrated by a term called Purchasing Power Parity.

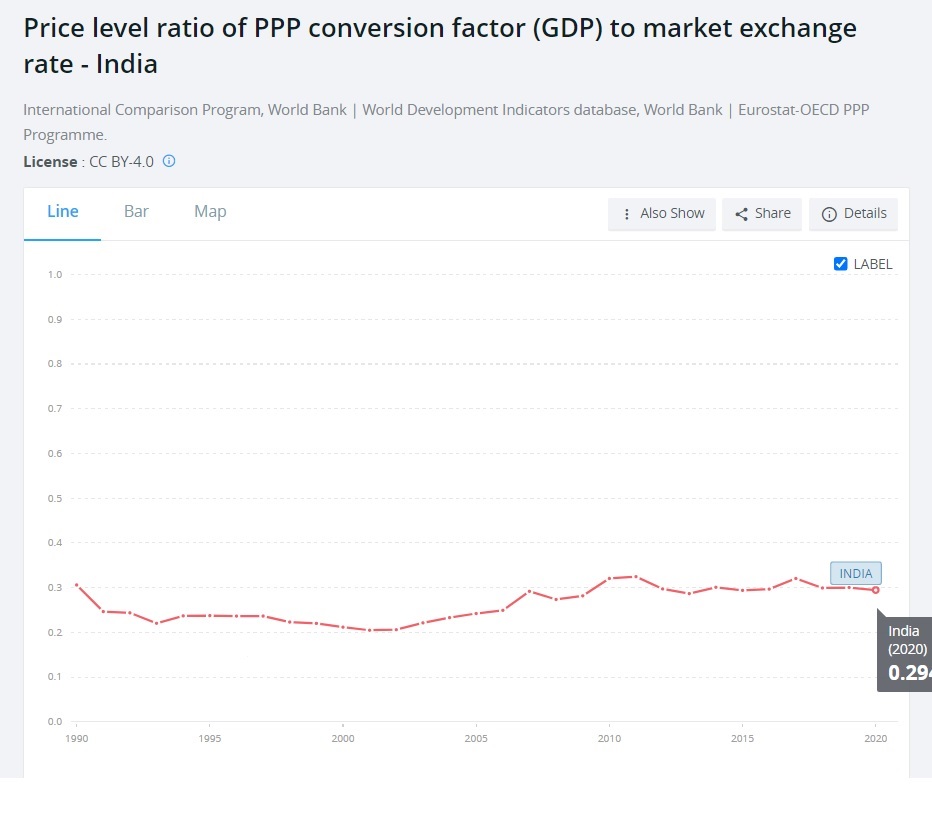

In simpler terms – to buy items in a given list, if you are spending 100 USD in the USA, for the same list how much money you will spend in India in INR. Convert that INR to USD using Forex Rate. As per the World bank which publishes this data on regular basis, it says, you will spend 30 USD for this list in INR. It means 30*75 INR or 2250 Rupees are worth 100 USD from the value of money perspective. From a Price point parity point of view, 1 USD is equivalent to 22.50 Rupees in July 2021. In 2020, it was 21.99 Rupees per USD as per world bank.

This is a difficult-to-believe concept but it is true. So basically in India things and services are generally at a 70% discount. It may not be true for specific things or services but when you consider many things and services, it comes to be at an average 70% discount. To calculate this, the World Bank and other institutions use a basket of things & services. If you apply this 70% discount to the USD Exchange rate, you get 22.5 INR as a real value of 1 USD.

Let me give an example of one item – Cottage Cheese – 1 Kg of it costs approx. 300 Rupees in India. 10 Ounces (approx. 300 gm) in Walmart costs 4 USD. 1 Kg will cost 13.33 USD in the USA or 13.33*75 = 1000 INR if you carried this money from India. So 13.33 USD give you value worth 300 Rupees for cottage cheese (paneer). Coincidently this item is at around 70% discount in India. Some items will be cheaper and some will be more expensive. But when you look for an average of 3 to 4 years of your consumption of goods (capital and consumables) and services, on average in India this consumption basket is at a 70% discount using a single currency (transferred using exchange price).

Now let us compare this with other countries. Sudan, Iran, Pakistan, etc. are cheaper countries with respect to India. In USD you spend less money on the same product. Switzerland, Norway is expensive in USD term.

Let us now compare “Salaries” in PPP terms. The purchasing power of someone earning 22.5 Lacs/Year (30K USD @ 75 INR) in India is the same as someone with 100K USD/year in the USA will have. This is considered for an average of the 5-year term. The savings in the USA, if bought back to India will get the benefit of Forex rate (1 USD @75 INR) but it would give only PPP value (@22.5 INR) if used in the USA.

In case you are planning to spend 2 years in the USA and want to maximize your savings and bring those back to India, all saving will convert as per the Forex rate. However if you consume that saving in the USA, you will get value in the USA terms. Let us take the example of 100 USD – when brought to India, you will get 7500 INR. However, you will be able to buy goods and services worth 300 USD with the same money.

I understand many people will not be able to digest this concept and hence I am giving few tables and graphs along with links to have a detailed understanding. Before you take the big decision of moving out of India or to anywhere else understand these concepts and analyze. There is no harm in migrating but you don’t want surprises in life. If you know you are not going to make money but will have different experiences, you should do that. I have spent many years in the US (Silicon Valley, Seattle Area, Chicago Area) and now settled in India (Currently in Mumbai). I used to travel across the world on my own before Covid and hope to do the same again soon. My experience tells me that concept of PPP can help people take informed decisions.

Some more discounted countries. For example, in Sudan, you buy the same things at a 90% discount with respect to the USA. It means India is 3 times expensive than Sudan.

Some of the expensive countries for Indian.

Few articles and data sources to understand Price Point Parity

https://data.worldbank.org/indicator/PA.NUS.PPPC.RF?locations=IN&most_recent_value_desc=false

Conversion Rate as per PPP

https://data.worldbank.org/indicator/PA.NUS.PPP

Indian GDP in PPP Terms is 9.5 Trillion… what it means, if we take all these items and services of India in US market, we will get 9.5 Trillion. But if get 2.8 Trillion USD and transfer them to India using Forex, 2.8 Trillion is sufficient to buy whole India’s good and services.

Got to know about ‘PPE’ and how does it work.Artifacts that will help us to make decision in this regard.Well explained